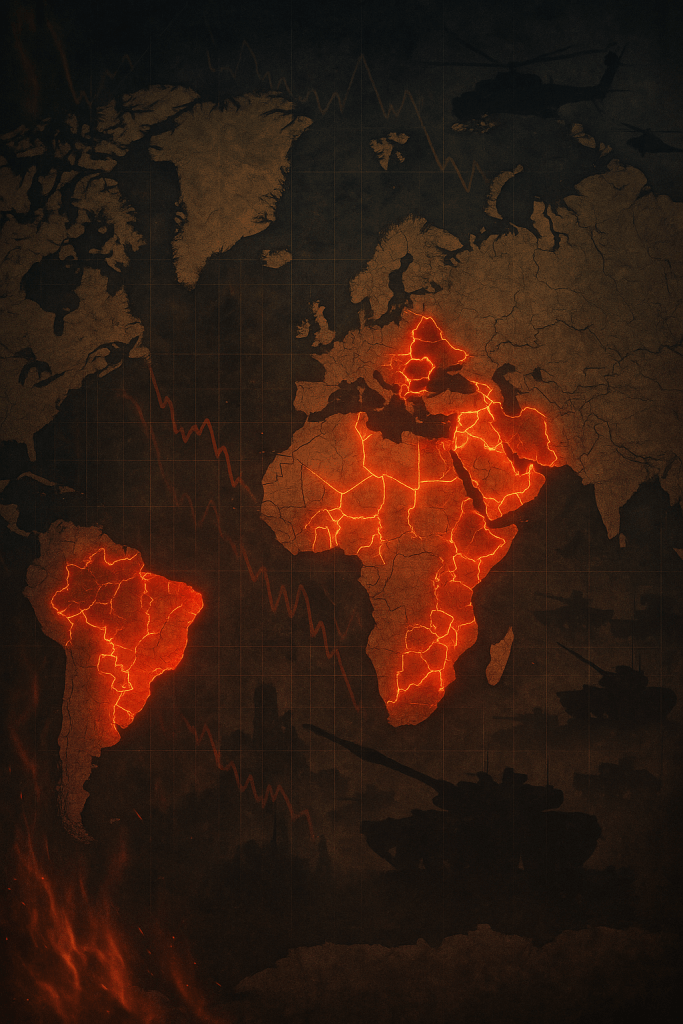

A Geopolitical Breakdown of the Nations Most at Risk in a Global Conflict

War isn’t just about tanks and troops — it’s about economics, resilience, and strategy. In the hypothetical (yet increasingly relevant) scenario of a World War III, not all nations are built to withstand the pressure.

Some would collapse within weeks — financially, politically, or socially.

This list isn’t based on military power alone. It takes into account economic fragility, geopolitical exposure, debt levels, food dependence, and civil unrest potential.

Let’s break down the countries that are most likely to fail first if global war erupts — and why.

1. Lebanon

- Why it’s vulnerable: Lebanon is already grappling with one of the worst economic collapses in modern history. High inflation, political instability, and food import dependence make it extremely fragile.

- What could happen: A global conflict could cut off aid and worsen its internal chaos, leading to total institutional breakdown.

2. Sri Lanka

- Why it’s vulnerable: Still recovering from economic default and civil unrest in 2022–2023.

- What could happen: War would likely disrupt supply chains, and any drop in tourism or trade would push the nation back into deep crisis.

3. Pakistan

- Why it’s vulnerable: High debt, energy insecurity, political instability, and rising extremism.

- What could happen: Under wartime stress, internal conflict could escalate, and the military might struggle to hold the country together.

4. Nigeria

- Why it’s vulnerable: Oil-dependent economy, high youth unemployment, and ongoing internal conflicts.

- What could happen: A global war could tank oil prices or disrupt exports, cutting off a major revenue source and fueling unrest.

5. Argentina

- Why it’s vulnerable: Chronic inflation, IMF dependency, and fiscal instability.

- What could happen: War would put even more pressure on its fragile economy, making default or political upheaval almost inevitable.

6. Egypt

- Why it’s vulnerable: Massive food import dependency, high debt, and public discontent.

- What could happen: If global supply chains collapse, Egypt could face food shortages and social chaos.

7. North Korea (Yes, really)

- Why it’s vulnerable: Despite military bravado, the regime is extremely isolated and relies on China for economic survival.

- What could happen: A global war that pulls China inward could leave North Korea exposed and economically paralyzed.

8. Turkey

- Why it’s vulnerable: High inflation, controversial leadership, and regional tensions.

- What could happen: If war expands into the region, Turkey’s economy could spiral, and civil-military conflict could erupt.

9. El Salvador

- Why it’s vulnerable: Bitcoin gamble, external debt, and limited industrial base.

- What could happen: A major global shock could destroy investment flows, and the country may struggle to finance even basic imports.

10. South Africa

- Why it’s vulnerable: Deep inequality, power grid failures, and high unemployment.

- What could happen: Wartime pressures could intensify domestic unrest and cripple infrastructure even further.

In a World War III scenario, collapse wouldn’t just come from bombs — it would come from economic fragility, social fracture, and dependency on fragile systems.

While major powers would be focused on the battlefield, these nations could implode from within.

Want more insights into geopolitics, economic risk, and global strategy? Subscribe to our newsletter for weekly breakdowns.