Understanding Stablecoins: Tools, Not Investments

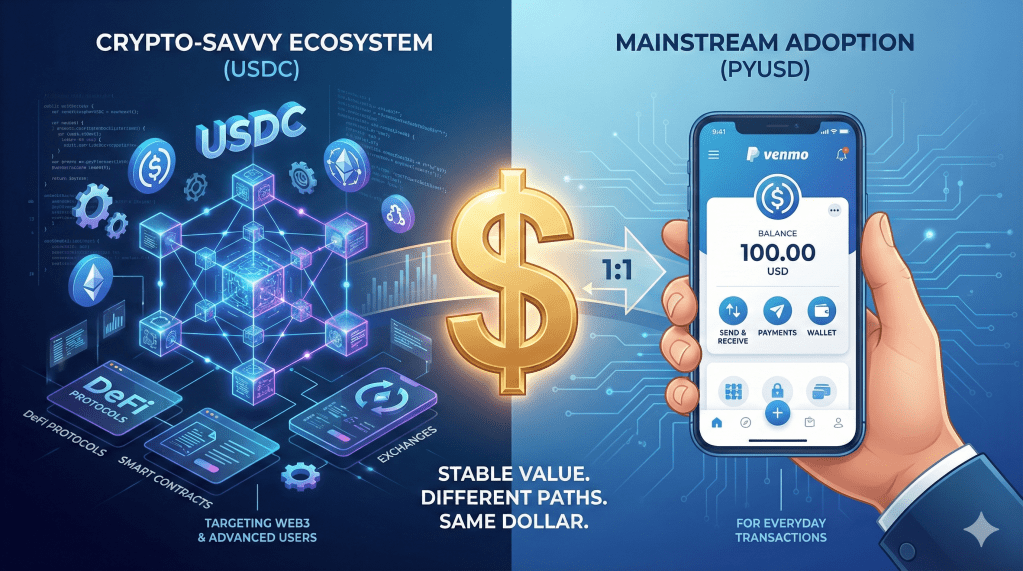

Stablecoins represent a unique category in the cryptocurrency ecosystem. Unlike Bitcoin or Ethereum, these digital assets aren’t designed to appreciate in value. Instead, they maintain a consistent 1:1 peg with traditional currencies—in this case, the U.S. dollar. The primary purpose of stablecoins is utility: facilitating quick, cost-effective global transactions without the delays inherent in traditional banking systems.

Two prominent stablecoins currently dominating different segments of the market are USD Coin (USDC) and PayPal USD (PYUSD). While both maintain dollar parity, they serve distinctly different user bases and purposes within the broader digital economy.

The Cryptocurrency Native: USD Coin (USDC)

Market Position and Infrastructure

USD Coin launched in 2018 through Circle Internet and has established itself as fundamental infrastructure within the cryptocurrency ecosystem. As of early 2026, USDC maintains a market capitalization of approximately $73 billion, representing roughly 24% of the global stablecoin market. This positions it as the second-largest stablecoin by market cap, trailing only Tether (USDT).

What distinguishes USDC from competitors is its emphasis on regulatory compliance and transparent reserve management. Circle has built a reputation for maintaining verifiable cash reserves, addressing concerns that have plagued other stablecoins in the industry.

Ecosystem Integration

USDC functions as the default settlement currency across numerous cryptocurrency exchanges and decentralized finance (DeFi) platforms. Traders use it as a quote currency for countless trading pairs, making it the bridge between different cryptocurrencies. On decentralized exchanges, USDC serves as the settlement layer, while DeFi protocols utilize it for lending, borrowing, and yield generation activities.

The transaction volume tells a compelling story about USDC’s utility. During the third quarter of 2025 alone, on-chain transaction volume reached $9.6 trillion, representing a remarkable 580% year-over-year increase. This massive volume reflects active usage rather than passive holding—money constantly moving through the cryptocurrency economy.

Multi-Chain Flexibility

One of USDC’s most powerful features is its availability across more than a dozen different blockchain networks. This multi-chain presence allows users to move dollar-denominated value between different cryptocurrency ecosystems without converting to various native tokens. For developers building cross-chain applications, traders managing portfolios across multiple platforms, and institutions seeking interoperability, USDC acts as a universal translator.

Technical Requirements

The trade-off for this power and flexibility is complexity. Using USDC effectively requires understanding cryptocurrency fundamentals. Users need digital wallets, must comprehend gas fees (transaction costs), and should know which blockchain network they’re operating on. While this presents no obstacle for experienced cryptocurrency users, it creates a significant barrier for mainstream adoption.

The Consumer-Friendly Alternative: PayPal USD (PYUSD)

Simplified Entry Point

PayPal launched PYUSD in August 2023 with a fundamentally different value proposition. Rather than competing in the cryptocurrency-native space, PayPal positioned PYUSD as a bridge connecting traditional finance with digital assets. The stablecoin lives entirely within the PayPal and Venmo ecosystems, eliminating the technical complexities that intimidate mainstream users.

Purchasing, holding, and transferring PYUSD requires nothing more than tapping within familiar payment applications. There are no seed phrases to secure, no blockchain networks to select, and no learning curve to navigate. Users interact with PYUSD exactly as they would with any other balance in their PayPal or Venmo accounts.

Target Audience Strategy

PayPal isn’t pursuing the cryptocurrency power user demographic. Instead, the company targets its existing user base of hundreds of millions who have never engaged with digital assets. PYUSD represents a gentle introduction to blockchain technology and digital currencies, allowing PayPal to say “we support stablecoins” without requiring customers to alter their established financial behaviors.

This approach makes PYUSD ideal for users who want exposure to digital dollar technology but prefer remaining within PayPal’s familiar, trusted environment. The company leverages its brand recognition and user trust to lower the psychological barriers to stablecoin adoption.

Ecosystem Limitations

The simplicity comes with significant constraints. PYUSD doesn’t function outside PayPal’s controlled environment. Users cannot deploy it on decentralized exchanges, cannot earn yield through DeFi lending protocols, and cannot transfer it across multiple blockchain networks. The stablecoin remains tethered to a single ecosystem.

For PayPal’s target audience—mainstream consumers seeking simplicity—these limitations matter little. The product works exactly as designed. However, for anyone with deeper cryptocurrency involvement or interests in DeFi, these constraints represent meaningful functionality gaps.

Adoption Metrics

Market adoption has progressed slowly compared to established stablecoins. PayPal doesn’t publicly disclose PYUSD circulation figures in earnings reports, and the token maintains a relatively modest market presence with approximately $3.7 billion in market capitalization as of early 2026. This represents a tiny fraction of the overall stablecoin market.

PayPal’s underlying bet is that mainstream consumer reach will ultimately prove more valuable than cryptocurrency-native credibility. While this strategy hasn’t yet delivered breakthrough results, PYUSD serves an important strategic role for PayPal, positioning the company within the evolving digital asset landscape while keeping one foot firmly planted in traditional payment processing.

Comparing Practical Utility

Yield Opportunities

Both stablecoins offer interest-earning potential, though through different mechanisms. USDC typically generates yields around 3.5% APR through DeFi protocols or cryptocurrency exchange savings accounts. These returns come from lending markets where borrowers pay interest to access USDC liquidity.

PYUSD offers approximately 3.75% APR directly within the PayPal application. This slightly higher rate likely reflects PayPal’s need to incentivize adoption and retention. The yield is automatically applied without requiring users to understand or interact with underlying DeFi protocols.

These single-digit annual yields represent the primary way stablecoin holders can generate returns while maintaining dollar stability. Neither token offers capital appreciation potential—maintaining the dollar peg is the fundamental design goal.

Liquidity and Acceptance

USDC enjoys dramatically broader acceptance across the cryptocurrency ecosystem. Major exchanges list hundreds of USDC trading pairs. DeFi protocols integrate USDC as a primary asset. Cross-border payment services accept USDC transfers. This widespread acceptance makes USDC highly liquid—easily converted to other assets or moved between platforms.

PYUSD’s liquidity remains confined to PayPal’s ecosystem. While this ensures seamless movement within PayPal and Venmo, it limits interoperability with the broader cryptocurrency world. Users cannot easily bridge PYUSD to external DeFi platforms or exchanges without first converting to another asset.

Security and Trust Models

USDC relies on blockchain transparency and Circle’s commitment to regulatory compliance. The company publishes regular attestations of its reserves, providing visibility into backing assets. Users must trust both Circle’s management and the security of their own private keys and wallets.

PYUSD leverages PayPal’s established reputation in consumer finance and payment processing. Users trust PayPal’s centralized infrastructure rather than managing their own security. This trade-off—giving up self-custody for simplified security—appeals to mainstream users but contradicts cryptocurrency’s decentralization ethos.

Making Your Choice

For Cryptocurrency-Active Users

If you regularly trade cryptocurrencies, participate in DeFi protocols, or move assets across different blockchain networks, USDC represents the clear choice. Its widespread acceptance, multi-chain availability, and deep integration into cryptocurrency infrastructure make it indispensable. The technical requirements that intimidate newcomers pose no barrier to experienced users who already maintain wallets and understand blockchain mechanics.

USDC’s massive transaction volume and market capitalization reflect its position as essential cryptocurrency plumbing. For anyone building applications, trading actively, or seeking maximum flexibility in deploying dollar-denominated value across the cryptocurrency ecosystem, USDC delivers unmatched utility.

For Mainstream PayPal Users

If you primarily use PayPal or Venmo for everyday transactions and want simple exposure to stablecoin technology, PYUSD serves its purpose admirably. The zero learning curve, familiar interface, and seamless integration with existing payment workflows make it accessible. The slightly higher yield compared to USDC provides modest additional incentive.

PYUSD works well for users who want to park dollars digitally, earn some yield, and maintain flexibility for potential future expansion into cryptocurrency—all without leaving PayPal’s comfortable ecosystem. The limitations don’t matter if you weren’t planning to explore DeFi or cross-chain transactions anyway.

Portfolio Approach

Many users may benefit from holding both stablecoins for different purposes. Keep USDC in cryptocurrency exchange accounts or DeFi wallets for trading and protocol interactions. Maintain PYUSD in PayPal for everyday payment flexibility and as a simple savings vehicle. Each tool excels in its designed context.

Understanding the Broader Context

Stablecoin Market Evolution

The stablecoin market continues evolving rapidly. Regulatory frameworks are developing across jurisdictions, with governments increasingly recognizing stablecoins as important financial infrastructure. Both USDC and PYUSD position themselves as compliant, transparent options in an ecosystem that has faced scrutiny over reserve backing and operational transparency.

Market dynamics suggest continued growth for stablecoins overall. As cryptocurrency adoption expands and DeFi protocols mature, demand for stable, dollar-denominated digital assets will likely increase. USDC’s first-mover advantage and extensive integration give it strong positioning. PYUSD’s challenge is converting PayPal’s massive user base into active stablecoin adoption.

Institutional Considerations

Institutions exploring stablecoin integration typically gravitate toward USDC due to its transparency, regulatory compliance focus, and widespread acceptance. Circle has cultivated relationships with traditional financial institutions, making USDC more palatable for conservative treasury management and corporate adoption.

PayPal’s institutional play differs—leveraging its merchant network and payment processing infrastructure to potentially integrate PYUSD into e-commerce and payment flows. This strategy targets payment facilitation rather than treasury management or trading infrastructure.

Final Recommendations

Neither USDC nor PYUSD represents an “investment” in the traditional sense. You won’t generate capital gains holding these assets over time. The dollar peg is the point—stability, not appreciation.

Choose based on how you actually use money in digital contexts. For cryptocurrency trading, DeFi participation, or cross-chain value transfer, USDC is essential infrastructure. For simple digital dollar storage within PayPal’s ecosystem, PYUSD provides zero-friction access.

The “better buy” depends entirely on your use case, technical comfort level, and where you conduct digital financial activities. Both stablecoins successfully maintain dollar parity while serving their intended audiences. Select the tool that matches your specific needs, or use both strategically in their appropriate contexts.

As the stablecoin market matures and regulatory clarity improves, both options will likely refine their offerings and expand capabilities. For now, understanding the fundamental differences in design philosophy, target audience, and ecosystem integration helps you make an informed choice for your particular situation.

Want to actually take action instead of just reading?

Most people understand what they should do with money — the problem is execution. That’s why I created The $1,000 Money Recovery Checklist.

It’s a simple, step-by-step checklist that shows you:

and how to start building your first $1,000 emergency fund without overwhelm.

- where your money is leaking,

- what to cut or renegotiate first,

- how to protect your savings,

- and how to start building your first $1,000 emergency fund without overwhelm.

No theory. No motivation talk. Just clear actions you can apply today.

If you want a practical next step after this article, click the button below and get instant access.

>Get The $1,000 Money Recovery Checklist<