When analyzing the investment portfolios of tech billionaires, few names command as much attention as Peter Thiel. With a net worth hovering around $24.6 billion and a track record that includes co-founding PayPal, serving as Facebook’s first external investor, and launching Palantir Technologies, Thiel’s investment decisions are scrutinized by market watchers worldwide. What makes his current artificial intelligence stock holdings particularly intriguing is what’s not in his portfolio as much as what is.

The Surprising Absences: Palantir and Nvidia

Perhaps the most eyebrow-raising aspect of Thiel’s hedge fund portfolio as of the third quarter of 2025 is the complete absence of two powerhouse AI stocks: Palantir Technologies and Nvidia. Despite co-founding Palantir, the data analytics giant that has become synonymous with AI-powered government and enterprise solutions, Thiel’s fund holds zero shares. Even more striking is the lack of Nvidia holdings, particularly given the chipmaker’s dominant position in the AI revolution.

This strategic positioning reveals a sophisticated investment philosophy that extends beyond simple brand recognition or market momentum. Instead, Thiel’s current AI exposure concentrates on just three carefully selected technology giants, each representing a distinct thesis about how artificial intelligence will reshape industries and create value over the coming decades.

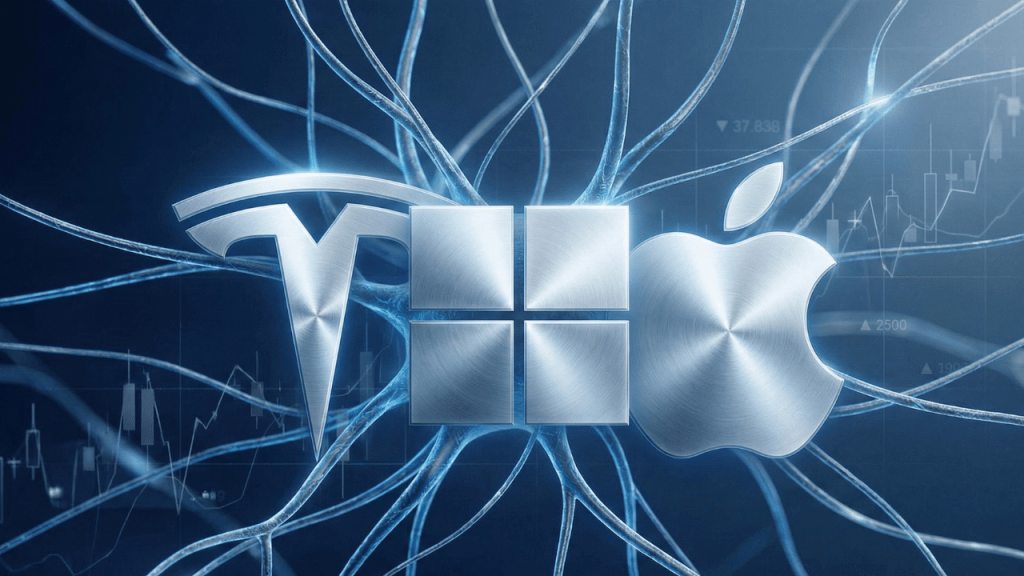

Investment #1: Tesla – The Autonomous Driving Pioneer

Current Position: Largest holding in portfolio (after 76% reduction in Q3 2025)

Stock Price (Feb 9, 2026): $417.65

Market Cap: $1.4 trillion

YTD Change: +1.59% ($6.54)

Tesla represents Thiel’s conviction in practical AI applications rather than abstract technological capabilities. While the billionaire investor has previously characterized artificial intelligence as “slightly overhyped,” he’s demonstrated clear enthusiasm for autonomous vehicle technology, which he views as a transformative innovation with tangible real-world impact.

The electric vehicle manufacturer’s competitive advantage in self-driving technology stems from an unparalleled data asset: billions of real-world autonomous miles accumulated through its fleet. This massive dataset creates a formidable moat that competitors will struggle to replicate, positioning Tesla uniquely in the race toward fully autonomous transportation.

However, Thiel’s substantial 76% position reduction during the third quarter signals potential concerns about strategic direction. Industry observers note that this timing coincides with CEO Elon Musk’s increasing emphasis on humanoid robot development. Thiel has publicly expressed skepticism about Musk’s vision of deploying 1 billion humanoid robots within a decade, suggesting a philosophical divergence on where AI investment should be concentrated.

Despite the dramatic trimming, Tesla’s retention as the fund’s top holding indicates Thiel maintains fundamental confidence in the autonomous driving thesis, even if questions exist about ancillary strategic initiatives.

Investment #2: Microsoft – The AI Builder, Not the Shovel Seller

Current Position: 49,000 shares (new Q3 2025 purchase)

Portfolio Weight: Approximately 34%

Stock Price (Feb 9, 2026): $414.12

Market Cap: $3.0 trillion

YTD Change: +3.24% ($12.98)

Thiel’s Microsoft investment embodies a sophisticated framework for evaluating technology revolutions. The billionaire investor distinguishes between “shovel sellers” who provide infrastructure tools and “builders” who create end-user applications and integrated solutions. In this paradigm, companies like Nvidia function as shovel sellers, manufacturing the GPUs that power AI systems. Meanwhile, Microsoft operates as a builder, integrating artificial intelligence into cloud platforms, productivity software, and enterprise solutions that directly serve customer needs.

This philosophical distinction explains why Thiel’s fund completely exited its Nvidia position while simultaneously establishing a substantial Microsoft stake during the same quarter. The timing suggests conviction that value migration within the AI ecosystem will increasingly favor companies that deliver complete, integrated solutions rather than component manufacturers.

Microsoft’s recent stock volatility following its fiscal 2026 second-quarter earnings likely doesn’t concern Thiel. While Azure cloud service growth disappointed some investors, the underlying reason actually supports the builder thesis: Microsoft allocated more data center capacity to internal development rather than external customer sales. This strategic choice prioritizes long-term product development over short-term revenue maximization, precisely the type of forward-thinking approach that aligns with Thiel’s investment philosophy.

With comprehensive AI integration across Office 365, Azure, GitHub Copilot, and emerging consumer applications, Microsoft demonstrates the breadth of opportunity available to builders who can leverage AI across multiple product lines and customer segments.

Investment #3: Apple – The Distribution Network and Vertical Integration Play

Current Position: 79,000 shares (new Q3 2025 position)

Stock Price (Feb 9, 2026): $274.97

Market Cap: $4.1 trillion

YTD Change: -1.04% (-$2.89)

Apple’s inclusion in Thiel’s AI portfolio might initially seem counterintuitive. The iPhone manufacturer has widely been characterized as lagging competitors in generative AI development, with critics pointing to the delayed rollout of AI features compared to rivals. However, Thiel’s investment likely reflects two powerful competitive advantages that transcend first-mover status.

The Distribution Advantage: With 2.5 billion iPhones currently in use globally, Apple controls one of the largest AI distribution networks on the planet. This installed base provides immediate scale for any AI feature or capability the company introduces. While Apple may not pioneer every AI breakthrough, its ability to deploy innovations to billions of users overnight creates immense strategic value. The ongoing integration of Google Gemini with Siri expands these capabilities, while reported plans to launch AI-powered smart glasses later in 2026 could further extend Apple’s AI distribution reach.

The Vertical Integration Thesis: Thiel has articulated strong views on vertical integration as an underutilized approach to technological advancement. Apple’s custom silicon strategy, particularly its AI-optimized chip designs, enables integration levels that horizontally-focused competitors cannot match. By controlling the entire stack from chip architecture through operating system to application layer, Apple can optimize AI performance and create differentiated user experiences in ways that companies relying on third-party components cannot replicate.

This vertical integration approach also provides strategic flexibility. As AI workloads evolve and requirements change, Apple can adapt its chip designs specifically for its own needs rather than relying on general-purpose solutions optimized for broader market demands.

The Broader Investment Philosophy: Practical AI Over Hype

Examining these three holdings collectively reveals a coherent investment thesis that diverges from mainstream AI enthusiasm. Rather than chasing companies with the highest AI-related revenue growth or the most impressive technological capabilities in isolation, Thiel appears focused on businesses that can translate AI advantages into sustainable competitive moats and profitable business models.

Tesla brings proprietary autonomous driving data at unprecedented scale. Microsoft offers integrated AI solutions across cloud and productivity ecosystems with established enterprise relationships. Apple provides massive distribution reach combined with vertically integrated optimization capabilities. Each position represents a different angle on how AI creates defensible value rather than simply generating technological impressiveness.

This pragmatic approach also explains the Nvidia absence. While Nvidia’s GPUs remain essential AI infrastructure, commodity hardware faces ongoing competitive pressure and margin compression as alternatives emerge. Thiel’s “shovel seller versus builder” framework suggests skepticism about long-term value capture in component manufacturing relative to integrated solution providers.

Market Performance Context

As of February 9, 2026, these three holdings present varying performance trajectories:

- Tesla (TSLA): Trading at $417.65 with 52-week range of $214.25-$498.83, showing significant volatility but maintaining strong year-to-date momentum

- Microsoft (MSFT): Priced at $414.12 with 52-week range of $344.79-$555.45, recovering from recent cloud growth concerns

- Apple (AAPL): At $274.97 with 52-week range of $169.21-$288.62, experiencing slight near-term pressure despite strong underlying fundamentals

The combined market capitalization of these three holdings exceeds $8.5 trillion, representing a substantial portion of global equity market value concentrated in Thiel’s AI investment thesis.

Key Takeaways for Investors

Thiel’s portfolio construction offers several lessons for investors evaluating AI opportunities:

1. Distribution Matters: Companies with existing large-scale user bases can monetize AI innovations more effectively than pure-play technology providers without established distribution channels.

2. Integration Creates Value: Vertical integration and the ability to optimize entire technology stacks may prove more valuable than best-of-breed component approaches as AI matures.

3. Practical Applications Trump Hype: Real-world AI applications solving concrete problems may generate superior returns compared to companies primarily selling AI infrastructure or pursuing ambitious but uncertain moonshot projects.

4. Strategic Flexibility Matters: Companies that can adapt their AI strategies based on evolving market conditions and technological developments may outperform those locked into single approaches.

5. Value Migration Is Real: As technology revolutions mature, value often shifts from infrastructure providers to solution integrators and application developers with direct customer relationships.

Looking Forward

While past performance never guarantees future results, Thiel’s concentrated AI portfolio reflects decades of experience identifying transformative technology trends early and maintaining conviction through market cycles. His willingness to bypass obvious AI plays like Nvidia and Palantir in favor of less conventionally “pure AI” companies demonstrates sophisticated analysis of where sustainable value creation will occur.

For investors seeking to understand how experienced technology investors are positioning for the AI revolution, Thiel’s portfolio provides a masterclass in looking beyond surface-level narratives to identify companies with genuine competitive advantages in translating AI capabilities into profitable, scalable businesses.

As the artificial intelligence landscape continues evolving rapidly, monitoring how Thiel adjusts these positions in future quarters will offer valuable insights into whether the builder thesis continues holding versus shovel seller dynamics, and whether practical AI applications continue outperforming more speculative approaches.

Want to actually take action instead of just reading?

Most people understand what they should do with money — the problem is execution. That’s why I created The $1,000 Money Recovery Checklist.

It’s a simple, step-by-step checklist that shows you:

and how to start building your first $1,000 emergency fund without overwhelm.

- where your money is leaking,

- what to cut or renegotiate first,

- how to protect your savings,

- and how to start building your first $1,000 emergency fund without overwhelm.

No theory. No motivation talk. Just clear actions you can apply today.

If you want a practical next step after this article, click the button below and get instant access.

>Get The $1,000 Money Recovery Checklist<

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Stock prices and portfolio holdings mentioned are accurate as of February 9, 2026, but may change. Always conduct your own research and consult with financial professionals before making investment decisions.