Why Efficiency, AI, and Creator Leverage Are Beating Big Teams and VC Funding

Once upon a time, the goal was to build a startup.

Now? The smartest people are building one-person empires.

In 2025, solo creators, developers, educators, and operators are quietly outperforming traditional startups — not with massive teams or venture capital, but with systems, leverage, and ruthless simplicity.

They don’t raise money. They raise standards.

They don’t scale headcount. They scale content, code, and cashflow.

Let’s explore how solopreneurs are quietly winning — and why this might be the smartest model for modern wealth.

1. WHAT IS A ONE-PERSON EMPIRE?

It’s not just freelancing.

It’s not a side hustle.

A one-person empire is a lean, automated, high-profit business operated almost entirely by a single person using tools like:

- AI (for content, automation, communication)

- No-code tools (for landing pages, apps, funnels)

- Global freelancers (for specialized tasks)

- Digital distribution (YouTube, Substack, Gumroad, X)

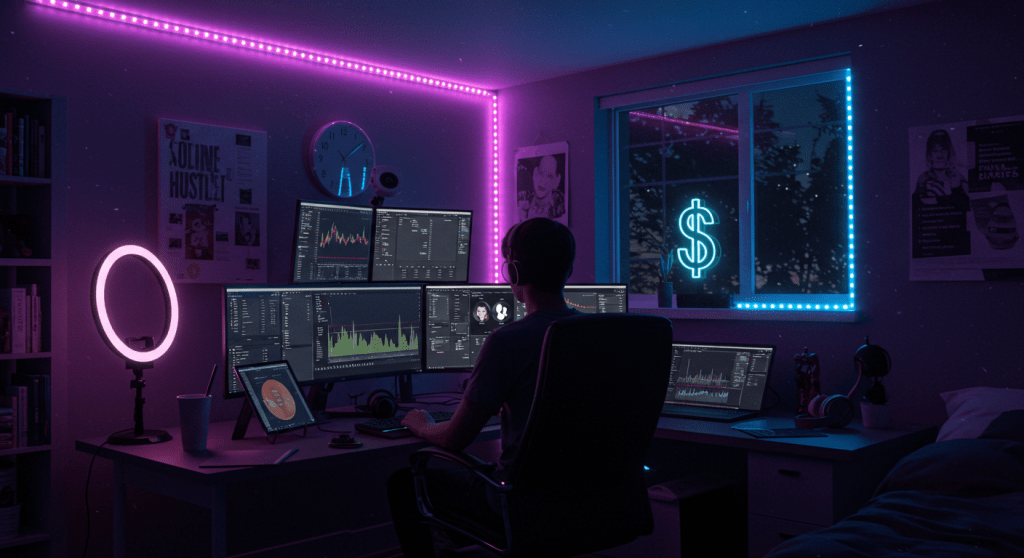

They operate from anywhere: cafés in Bali, co-working spots in Lisbon, or bedrooms in São Paulo. They work async, automate aggressively, and live life on their own terms.

The result? Massive impact — minimal complexity.

2. EXAMPLES OF ONE-PERSON EMPIRES IN 2025

- A faceless YouTube channel owner making $50K/month with AI-generated videos and affiliate links

- A Notion template creator selling $200K/year in digital products with just one landing page

- A Substack writer earning $25K/month through newsletters, courses, and private communities

- A solo dev launching AI SaaS tools with Stripe + Gumroad, no backend team

- A ghostwriter managing 10+ influencer accounts, building equity while remaining anonymous

- A TikTok creator who monetizes with TikTok Shop + digital eBooks, 100% automated by AI

No board meetings. No co-founder drama. No burnout.

Just clean execution, automated scale, and full control.

3. WHY THIS MODEL IS EXPLODING NOW

- AI is your team: Writers, designers, editors, assistants, all in your browser

- Platforms reward individuals: X, TikTok, Instagram, Substack favor personality over brand

- Low overhead = high profit: You keep 90%+ of the margin

- Freedom scales faster than funding: You own 100%, work anywhere, and change direction in a day

- Speed wins: Solo operators iterate 10x faster than traditional teams

Startups chase valuations. Solopreneurs chase cashflow and peace.

This isn’t a trend — it’s the lean revolution of the digital age.

4. TOOLS THAT POWER ONE-PERSON EMPIRES

- Content Creation: ChatGPT, Jasper, Notion AI, Descript, Pika, Midjourney

- Video & Audio: ElevenLabs, Runway, CapCut, Sora

- Automation: Zapier, Make.com, Airtable, Softr, Tally, Typedream

- Monetization: Stripe, Gumroad, Payhip, Ko-fi, ConvertKit

- Distribution: Substack, TikTok, X (Twitter), Reddit, YouTube, Threads

- Productivity & Planning: Notion, ClickUp, Cron, Sunsama

These tools reduce friction, enhance creativity, and remove the need for expensive hires.

5. HOW TO BUILD YOURS IN 2025

- Pick a niche you can serve with leverage — think frameworks, knowledge, storytelling, utility

- Build a simple product or content engine — even one offer that solves a deep problem

- Distribute daily — on 1-2 platforms you enjoy and where your audience lives

- Automate everything repeatable — use templates, zaps, AI tools, and SOPs

- Protect your time like a founder, not a freelancer — calendar discipline is key

- Reinvest in growth assets — skills, tools, visibility, audience, product improvements

Most importantly: stay lean. stay weird. stay consistent.

BONUS: MINDSETS OF SUCCESSFUL SOLOPRENEURS

- Less is more: Simplicity scales. Complexity kills.

- Be boring: Systems outperform dopamine.

- Obsess over leverage: Time, tools, distribution, and capital.

- Play long-term games: Build once, earn forever.

This isn’t about hustle culture. It’s about autonomy and asymmetry.

THE NEW POWER IS SMALL, SMART, AND SILENT

Big companies chase complexity. One-person empires chase clarity.

In 2025, it’s not about how many employees you have — it’s about how automated, profitable, and free you are.

The real flex isn’t raising capital. It’s raising income without raising stress.

You don’t need permission, investors, or a team. You just need focus + internet + execution.

Subscribe now to learn how to build your own one-person empire — powered by tools, trust, and total freedom.