While Major Economies Struggle, Spain Rises with Resilience, Infrastructure, and Smart Policy

In a time of economic turbulence and global slowdowns, one country is defying the odds and accelerating toward growth: Spain. According to the latest projections from the International Monetary Fund (IMF), Spain’s GDP is set to grow by an impressive 2.5% in 2025 — making it the only major economy in the world to receive an upward revision in the IMF’s World Economic Outlook.

This remarkable resilience positions Spain as a standout performer on the international stage. While the United States, Eurozone, and Asian giants like China and Japan revise their growth forecasts downward, Spain is charging ahead — backed by a combination of strategic investments, consumer confidence, and post-crisis recovery efforts.

In this article, we dive deep into the reasons behind Spain’s economic boom, the contrast with other global powers, and what it means for investors, businesses, and policy strategists.

SPAIN’S PROJECTED GROWTH: A STRONG 2.5% IN 2025

The IMF’s updated forecast has captured attention across financial media: Spain is now expected to grow by 2.5% in 2025. That’s not just solid growth — it’s exceptional, especially considering that most developed economies are struggling with stagnation, inflation, and trade-related headwinds.

Key drivers of Spain’s growth include:

- Targeted infrastructure investment after 2024’s severe floods

- Booming tourism and hospitality sectors

- Rising real wages and increased domestic consumption

- Limited exposure to U.S.-led trade tariffs

This is not a fluke or temporary rebound — it’s the result of sound macroeconomic planning and resilience in the face of adversity.

INFRASTRUCTURE INVESTMENT: POST-FLOOD RECONSTRUCTION BOOSTS GROWTH

One of the most significant growth catalysts is Spain’s large-scale infrastructure investment. In response to the devastating floods of 2024, both government and private sectors mobilized quickly, injecting billions of euros into rebuilding roads, public transit, water systems, and housing.

This reconstruction effort didn’t just restore functionality — it stimulated job creation, increased demand for materials, and opened up new business opportunities in construction and logistics.

According to the IMF, infrastructure-led growth is among the most sustainable strategies during economic uncertainty, and Spain’s model could serve as a roadmap for other nations.

TOURISM AND SERVICES SECTOR: A RESURGENT ECONOMIC ENGINE

Spain’s services sector — particularly tourism, real estate, and hospitality — has experienced a powerful rebound post-pandemic. In 2024, Spain welcomed over 85 million tourists, and that number is expected to climb even higher in 2025.

Hotels, airlines, restaurants, and entertainment companies have all reported record revenues. The tourism boom has had a multiplier effect: boosting local economies, increasing tax revenue, and supporting a wide range of secondary industries.

Spain’s brand as a luxury and cultural destination is stronger than ever, attracting high-spending visitors from the U.S., Latin America, China, and the Middle East.

DOMESTIC CONSUMPTION AND LABOR MARKET RESILIENCE

Rising real wages and strong labor protections have led to greater consumer confidence and spending. Household savings rates are declining moderately — not out of necessity, but due to increased willingness to spend on services, housing upgrades, and lifestyle enhancements.

This internal economic momentum is critical in an environment where external trade is facing headwinds. The Spanish government’s balanced approach to wage growth, fiscal discipline, and social investment has created a strong foundation for sustainable domestic demand.

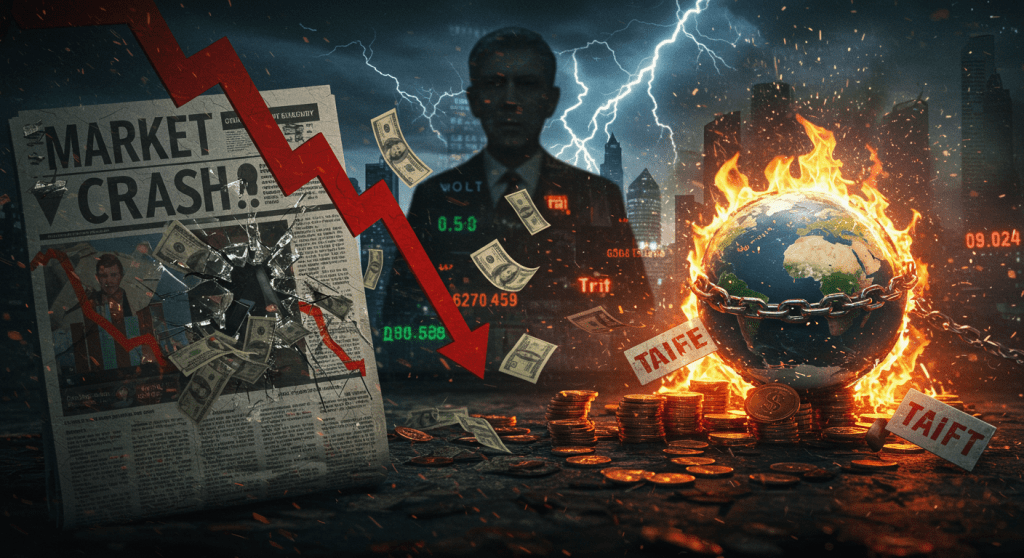

GLOBAL CONTEXT: A CONTRAST TO MAJOR ECONOMIC POWERS

While Spain moves forward, most major economies are stepping back:

- United States: Growth forecast reduced to 1.8% due to political uncertainty and tariff escalation

- Eurozone: Expected to grow just 0.8% in 2025, weighed down by Germany and France

- China: Facing structural slowdowns, with projected growth of 4%

- Japan: Barely avoiding recession with only 0.6% growth forecast

This contrast reinforces the importance of strategic resilience and diversification. Spain is succeeding by avoiding overexposure to the U.S.-China trade conflict and by nurturing diversified trade relationships across Latin America, Africa, and the EU.

IMPLICATIONS FOR INVESTORS AND BUSINESS STRATEGISTS

Spain’s success story offers valuable takeaways for investors and policymakers:

- Infrastructure investment pays dividends

- Tourism is a strategic industry, not just seasonal income

- Diversification is a defensive and offensive tool

- Social policies can coexist with strong growth

International investors are now eyeing Spanish real estate, green energy, and infrastructure firms as key entry points. Meanwhile, tech startups and fintech companies in Madrid and Barcelona are attracting increasing venture capital interest.

SPAIN’S LESSON FOR A POST-TARIFF, POST-PANDEMIC WORLD

Spain’s rise in 2025 is not just a national achievement — it’s a case study in how to weather global storms with strategy, agility, and vision. As the rest of the world navigates inflation, trade disputes, and political instability, Spain is proving that bold investment and diversified partnerships can turn crisis into opportunity.

For businesses, investors, and governments looking for inspiration or a new model to emulate, Spain may be the smartest economy to watch this year.

Want more exclusive insights like this? Subscribe to our newsletter and stay ahead of global economic trends.