Published: January 28, 2026

Introduction: The Power Behind AI’s Growth

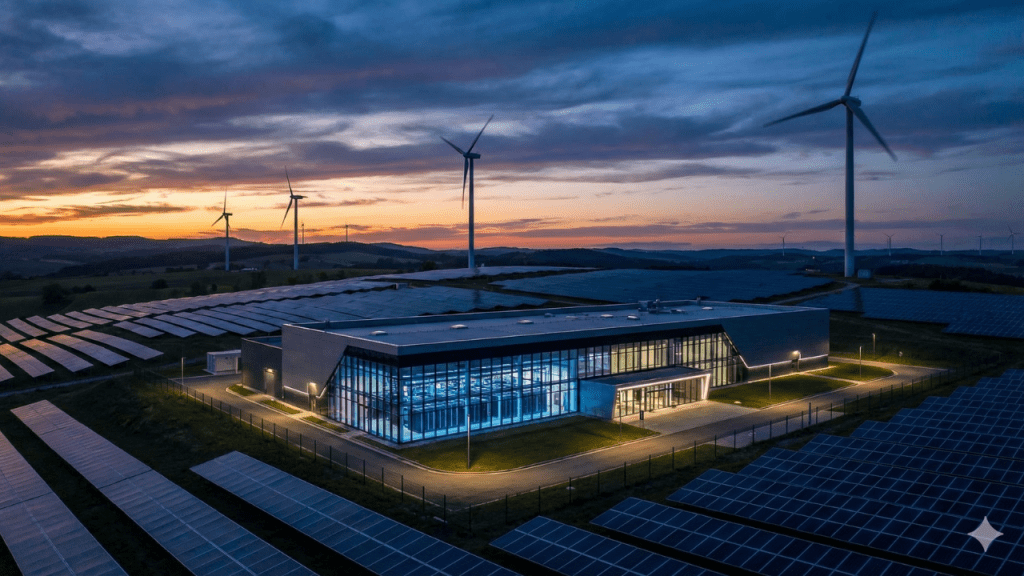

The artificial intelligence revolution isn’t just about algorithms and computing power. Behind every AI data center lies a critical dependency that often goes unnoticed by investors: reliable, sustainable electricity. As tech giants race to expand their AI capabilities, they’re turning to specialized energy providers to fuel their ambitions. One company stands out in this space, offering investors both substantial income and growth potential.

Brookfield Renewable Partners (NYSE: BEP) has emerged as a strategic partner for some of the world’s largest technology companies. With major agreements already in place with Microsoft and Google, this renewable energy provider is positioning itself at the intersection of two powerful trends: the AI boom and the global transition to clean energy.

Understanding Brookfield Renewable Partners’ Business Model

Brookfield Renewable Partners operates as a diversified clean energy company with a global footprint. The company’s portfolio spans multiple renewable energy technologies, including solar farms, wind installations, hydroelectric facilities, battery storage systems, and nuclear power assets. This diversification provides both stability and flexibility, allowing the company to serve clients with varying energy needs and geographic requirements.

The business model centers on long-term power purchase agreements with corporate and governmental clients. These contracts provide predictable revenue streams that support consistent dividend payments to investors. As of the third quarter of 2025, the company’s average contract duration stood at 13 years, demonstrating the long-term nature of client relationships in this sector.

What makes this business particularly attractive from an investment perspective is its built-in inflation protection. Approximately 70% of the company’s contracts include inflation adjustment mechanisms, helping to preserve the real value of cash flows over time. Additionally, three-quarters of revenue comes from operations in developed markets, reducing geopolitical and currency risks that might affect emerging market investments.

The AI Data Center Opportunity

The exponential growth of artificial intelligence has created unprecedented demand for data center capacity. However, building these facilities requires massive amounts of reliable electricity. A single large-scale data center can consume as much power as a small city, making energy infrastructure a critical bottleneck in AI expansion plans.

Technology companies are increasingly seeking renewable energy sources for their data centers, driven by both corporate sustainability commitments and practical energy security concerns. This is where Brookfield Renewable Partners has carved out a significant competitive advantage.

The Google Partnership

The company has secured an agreement with Google to provide 3 gigawatts of renewable power capacity. This substantial commitment reflects Google’s ongoing expansion of AI infrastructure and its need for reliable, clean energy sources. Three gigawatts represents enough capacity to power millions of homes, illustrating the scale of energy requirements in modern AI operations.

The Microsoft Agreement

Even more impressive is Brookfield’s partnership with Microsoft, encompassing 10.5 gigawatts of power capacity. This makes it one of the largest renewable energy agreements in the technology sector. Microsoft has been particularly aggressive in securing power for its Azure cloud platform and AI services, including its integration of OpenAI’s technology.

These agreements are structured to support future development rather than existing capacity alone. As these tech giants build new data centers over the coming years, Brookfield will be constructing the renewable energy infrastructure to power them.

Financial Performance and Investment Metrics

Current Valuation and Yield

As of January 28, 2026, Brookfield Renewable Partners trades at $29.05 per share, representing a market capitalization of approximately $8.8 billion. The stock offers a distribution yield of 5.2%, which is substantially higher than the average S&P 500 dividend yield and competitive with other income-focused investments in the current market environment.

The 52-week trading range of $19.29 to $32.72 shows the stock has experienced volatility, which is typical for the renewable energy sector. However, this volatility can create entry opportunities for patient, long-term investors focused on income and growth.

Growth Trajectory and Capital Investment Plans

Management has outlined an ambitious capital deployment strategy over the next five years, with planned investments totaling between $9 billion and $10 billion. This spending will fund new renewable energy projects, including those tied to the Microsoft and Google agreements, as well as other opportunities in the expanding clean energy market.

The company projects these investments will drive funds from operations growth of at least 10% annually. This operational growth provides the foundation for the company’s distribution growth target of 5% to 9% per year. For income investors, this combination of a high current yield plus mid-to-high single-digit distribution growth represents an attractive total return profile.

The Westinghouse Nuclear Opportunity

Perhaps the most intriguing aspect of Brookfield Renewable Partners’ portfolio is its 50% ownership stake in Westinghouse Electric Company, a global leader in nuclear power technology and services. While often overlooked by investors focused on solar and wind, this nuclear exposure could prove increasingly valuable.

Nuclear Power’s Renaissance

Nuclear energy is experiencing renewed interest as countries and corporations seek reliable, carbon-free baseload power. Unlike solar and wind, which are intermittent and require backup systems, nuclear plants can operate continuously, making them ideal for data centers that require 24/7 uptime.

Westinghouse currently derives approximately 85% of its revenue from servicing existing nuclear facilities worldwide. This services business provides stable, recurring revenue with high margins. The company maintains relationships with nuclear plant operators globally, providing fuel, maintenance, upgrades, and technical support.

The $80 Billion Government Contract

Recent developments have added significant potential upside to the Westinghouse investment. An $80 billion agreement with the U.S. government to develop new nuclear reactor capacity signals a potential shift from primarily servicing existing plants to building new ones. If executed successfully, this could dramatically expand Westinghouse’s revenue and profit potential.

For AI data centers, nuclear power offers several advantages over other energy sources. It provides consistent baseload power without weather dependency, produces no carbon emissions during operation, and requires relatively little land area compared to equivalent solar or wind capacity. As data center operators seek to ensure 99.999% uptime for critical AI applications, nuclear power’s reliability becomes increasingly valuable.

Competitive Advantages and Market Position

Several factors differentiate Brookfield Renewable Partners from competitors in the renewable energy space:

Scale and Diversification: The company’s global portfolio across multiple energy technologies provides both geographic and technological diversification. This reduces risk compared to companies focused on a single region or technology.

Financial Backing: As part of the Brookfield Asset Management family, the company has access to significant capital and expertise. Brookfield Asset Management is one of the world’s largest alternative asset managers, with deep experience in infrastructure investing.

Established Relationships: The existing contracts with Microsoft and Google demonstrate the company’s ability to win business from the world’s most demanding corporate customers. These relationships often lead to additional opportunities as clients expand their operations.

Nuclear Expertise: The Westinghouse ownership provides capabilities that pure renewable energy companies lack. As interest in nuclear power grows, this positions Brookfield uniquely in the market.

Investment Considerations and Risks

Interest Rate Sensitivity

Like most infrastructure and utility-like investments, Brookfield Renewable Partners can be sensitive to interest rate changes. When rates rise, high-yielding stocks often face pressure as bonds become more competitive. Investors should consider their interest rate outlook when timing purchases.

Execution Risk on Growth Projects

The ambitious $9-10 billion capital spending program carries execution risk. Construction delays, cost overruns, or regulatory challenges could impact returns on invested capital. However, the company’s track record and the backing of Brookfield Asset Management mitigate some of these concerns.

Regulatory and Policy Risk

Government policies significantly impact the renewable energy sector through tax credits, subsidies, and renewable energy mandates. Changes in political administrations or policy priorities could affect the economic attractiveness of new projects, though long-term trends favor clean energy regardless of short-term political shifts.

Technology Risk

The energy sector is subject to technological change. New battery storage technologies, more efficient solar panels, or breakthrough energy sources could disrupt existing business models. However, Brookfield’s diversification across technologies provides some protection against any single technology becoming obsolete.

Alternative Investment Option: Brookfield Renewable Corporation

For investors who prefer to avoid the tax complexities of partnership structures, Brookfield offers an alternative: Brookfield Renewable Corporation (NYSE: BEPC). This corporate structure holds the same underlying assets as BEP but in a form that issues 1099 tax forms rather than K-1s.

The tradeoff for this simplicity is a lower yield. BEPC currently yields 3.7% compared to BEP’s 5.2%. The yield differential exists because institutional investors, who often cannot hold partnerships for regulatory reasons, bid up BEPC’s price relative to BEP. Individual investors who can handle K-1 forms may prefer BEP’s higher yield, while those prioritizing tax simplicity might choose BEPC despite the lower payout.

Investment Thesis Summary

Brookfield Renewable Partners represents a unique opportunity to invest in the infrastructure enabling AI’s growth while generating substantial current income. The company’s position as a clean energy supplier to Microsoft and Google provides exposure to one of technology’s most important secular trends.

The 5.2% yield provides immediate income that exceeds most equity investments and many fixed-income alternatives. The projected 5-9% annual distribution growth offers income investors protection against inflation and the potential for increasing passive income over time. Combined, these factors suggest double-digit total return potential for patient investors.

The hidden value in Westinghouse adds an intriguing option on nuclear power’s potential renaissance. If nuclear becomes a preferred solution for data center power needs, this stake could prove significantly more valuable than currently reflected in the stock price.

Conclusion: A Compelling Risk-Reward Profile

As artificial intelligence transforms the global economy, the companies providing essential infrastructure to enable this transformation deserve investor attention. Brookfield Renewable Partners occupies a strategic position in this ecosystem, with established relationships with industry leaders and a diversified portfolio of energy assets.

The combination of high current yield, growth prospects tied to AI data center expansion, inflation-protected cash flows, and optionality on nuclear power creates a compelling investment case. While risks exist, as with any investment, the company’s scale, diversification, and financial backing provide important risk mitigants.

For investors seeking exposure to the AI revolution beyond software and semiconductor companies, or for income-focused investors looking for yield plus growth, Brookfield Renewable Partners deserves careful consideration. The stock’s relative obscurity compared to more widely followed technology names may present an opportunity for those willing to look beyond the obvious AI plays.

As data centers continue proliferating globally and energy requirements grow exponentially, the companies controlling power infrastructure will play an increasingly critical role. Brookfield Renewable Partners has positioned itself to capitalize on this trend while rewarding shareholders with substantial and growing distributions.

Want to actually take action instead of just reading?

Most people understand what they should do with money — the problem is execution. That’s why I created The $1,000 Money Recovery Checklist.

It’s a simple, step-by-step checklist that shows you:

and how to start building your first $1,000 emergency fund without overwhelm.

- where your money is leaking,

- what to cut or renegotiate first,

- how to protect your savings,

- and how to start building your first $1,000 emergency fund without overwhelm.

No theory. No motivation talk. Just clear actions you can apply today.

If you want a practical next step after this article, click the button below and get instant access.

>Get The $1,000 Money Recovery Checklist<

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Stock prices and yields mentioned are as of January 28, 2026, and may have changed since publication.

Leave a comment