How to hedge and stress-test your investments against Arctic escalations before markets price them in

The Scenario: When Geopolitics Arrives in Your Portfolio Unannounced

Imagine this: Markets open Monday to headlines of Arctic policy escalation. Rare-earth mineral futures gap up 8% before noon. Defense contractors rally while Nordic bond spreads widen. Your tech-heavy portfolio—loaded with chipmakers dependent on critical minerals—suddenly faces supply-chain uncertainty you hadn’t priced in.

This isn’t speculation. It’s the kind of overnight repricing that happens when geopolitical friction meets commodity chokepoints and defense posturing.

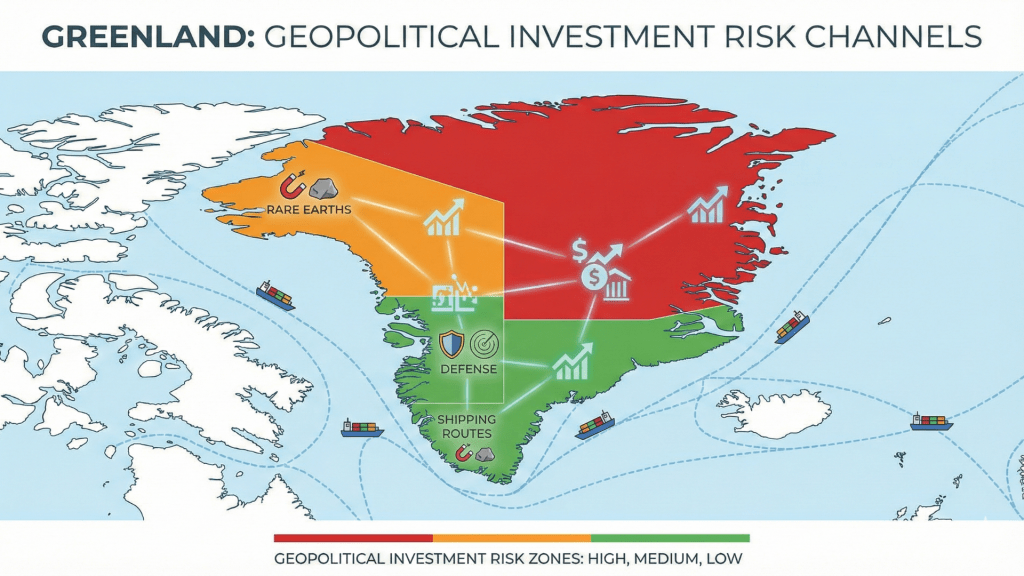

This article maps the financial channels through which reported U.S. interest in Greenland could affect your investments, then provides concrete operational steps to protect and hedge your portfolio starting today.

The Background: Why Investors Need to Track This Now

Reported political interest in acquiring or securing access to Greenland has drawn public rejections from Greenlandic and Danish officials, according to major international outlets. Analysts point to Greenland’s strategic Arctic position, shipping routes, military installations, and substantial deposits of rare-earth elements and other critical minerals.

Whether or not geopolitical moves escalate, the possibility alone introduces portfolio risk. Markets price uncertainty. Savvy investors stress-test against scenarios, not certainties.

The question isn’t whether acquisition happens. The question is: Are you positioned to withstand the market volatility, commodity shocks, and risk-off episodes that heightened tensions could trigger?

How Geopolitical Moves Affect Your Investments: The Five Channels

1. Commodity & Critical-Mineral Price Shocks

Greenland holds significant rare-earth deposits essential for semiconductors, batteries, and defense systems. Any perceived supply disruption—real or anticipated—can spike prices for these materials. Implication: Tech and clean-energy stocks with mineral-intensive supply chains face margin compression or input cost volatility. ETFs tracking materials and miners may see sharp moves.

2. Defense & Fiscal Spending Spikes

Escalations often trigger emergency defense appropriations and Arctic infrastructure spending. This shifts capital from other budget priorities and can widen fiscal deficits. Implication: Defense contractors and aerospace stocks rally; government bond yields may rise if deficits expand, pressuring rate-sensitive sectors like utilities and REITs.

3. Trade Disruptions & Sanctions

Geopolitical friction can produce retaliatory tariffs, export controls, or sanctions affecting transatlantic trade. Corporate earnings tied to European or Nordic supply chains face disruption. Implication: Multinational firms with Northern European exposure see earnings risk; import-dependent sectors face cost increases.

4. Market Sentiment & Risk-Off Episodes

Unexpected geopolitical headlines trigger flight-to-safety flows: investors dump equities and emerging-market bonds, piling into Treasuries, gold, and the dollar. Volatility spikes. Implication: Leveraged positions face margin calls; equity-heavy portfolios suffer drawdowns; options premiums surge, making hedges expensive after the fact.

5. Regional Banking and Sovereign Risk

Danish and Nordic bond markets, as well as currencies like the Danish krone, could experience volatility if tensions rise. Arctic-focused investment funds and regional banks face mark-to-market losses. Implication: Portfolios with Nordic sovereign bonds or Arctic development exposure see price and currency risk.

Practical, Ethical Protection Strategies: What You Can Do

1. Build a Liquidity Buffer and Stress Your Liquidity Plan

Hold cash or cash equivalents equal to 6–12 months of portfolio withdrawals or operating burn. Action: Calculate your monthly cash needs; verify liquid holdings cover that period. Move excess from illiquid positions if necessary. Note: Liquidity is your storm shelter during volatility. Consult your advisor on optimal levels.

2. Diversify Across Asset Classes and Geographies

Avoid concentration in single regions, sectors, or commodities. Blend equities, fixed income, commodities, and alternatives. Action: Run a portfolio audit today; identify overweight positions (>15% in one sector or region). Rebalance if needed. Note: Diversification reduces single-point-of-failure risk. Professional guidance ensures tax-efficient execution.

3. Consider Targeted Commodity and Minerals Exposure via ETFs

Rather than picking individual miners, use diversified ETFs tracking rare earths, lithium, or broad materials indices. Action: Research ETFs like those tracking critical minerals or precious metals; allocate a small hedging position (2–5% of portfolio). Note: Commodities can be volatile. Professionals can help size positions appropriately.

4. Explore Hedges with Options or Inverse ETFs (Advanced)

Put options on equity indices or inverse ETFs can offset downside during risk-off episodes. These instruments are complex and decay over time. Action: If experienced, consult your broker about protective puts on major holdings; if new to options, educate yourself first or hire a professional. Note: Hedging costs money and requires timing. Not suitable for all investors.

5. Allocate to Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) or inflation-linked bonds help preserve purchasing power if commodity shocks or fiscal spending fuel inflation. Action: Review fixed-income allocation; consider shifting 10–20% into TIPS or equivalent. Note: TIPS underperform in deflationary environments. Balance with nominal bonds.

6. Implement Currency Hedges for International Exposure

If you hold Nordic, European, or emerging-market assets, currency swings can amplify or offset returns. Action: Ask your advisor about currency-hedged ETFs or forward contracts to lock in exchange rates. Note: Currency hedging adds complexity and cost. Assess whether your exposure warrants it.

7. Review and Reduce Margin and Leverage

Leverage magnifies losses during drawdowns and can trigger forced liquidations. Action: Log into your brokerage account today; check margin utilization. Reduce leverage to comfortable levels (ideally <30% of equity). Note: Deleveraging improves resilience. Your advisor can model scenarios.

8. Run Scenario Stress Tests on Your Portfolio

Model how your holdings would perform under commodity shocks, equity drawdowns, or rate spikes. Action: Use portfolio analytics tools or request a stress test from your advisor; simulate a 15% equity drop, 10% commodity rally, and 50bp rate rise simultaneously. Note: Stress tests reveal hidden correlations and vulnerabilities.

9. Business Owners: Review Supplier Contracts and Inventory Policy

If you own or manage a business dependent on critical materials or European suppliers, assess contract terms and stockpile flexibility. Action: Schedule a 30-minute call with your procurement or finance lead; identify single-source suppliers and discuss inventory buffers or alternative vendors. Note: Operational resilience protects enterprise value.

10. Strengthen Cyber and Operational Readiness for Corporate Accounts

Geopolitical tensions often correlate with cyberattack risks targeting financial and corporate infrastructure. Action: Verify multi-factor authentication on all investment accounts; review cybersecurity protocols with your IT or wealth management team. Note: Operational security is portfolio security.

Low-Friction Actions You Can Complete in 24–72 Hours

Immediate Investor Checklist:

- Check margin usage and set alerts. Log in to your brokerage; confirm margin is <30% of equity. Set alerts if it rises above 40%.

- Verify liquidity buffer equals 6–12 months of expenses or withdrawals. Calculate monthly cash needs; ensure you hold that amount in money-market funds or short-term Treasuries.

- Set price alerts on commodity and critical-mineral ETFs. Choose 2–3 relevant tickers (e.g., rare-earth or materials ETFs); set alerts for 5% daily moves.

- Run a quick portfolio correlation check against commodity indices and USD. Use free tools like Portfolio Visualizer or request this from your advisor; identify overexposure to single risk factors.

- Contact your advisor to request a geopolitical stress test. Email or call today; ask for a scenario analysis modeling Arctic tensions, commodity shocks, and risk-off flows.

Mythbusting: What Investors Get Wrong About Geopolitical Risk

Myth 1: Geopolitics only matters to day traders.

Reality: Long-term investors suffer drawdowns and opportunity costs from geopolitical shocks. Strategic positioning protects compound returns.

Myth 2: Gold always wins during crises.

Reality: Gold rallies in some risk-off episodes but underperforms in others (especially when real rates rise). Diversification beats single-asset bets.

Myth 3: You can wait until tensions escalate to hedge.

Reality: Hedges become expensive or unavailable once markets price in risk. Proactive positioning is cheaper and more effective.

Shareable Pull Quotes

- “Markets price uncertainty, not certainty. Stress-test your portfolio against scenarios, not predictions.”

- “Liquidity is your storm shelter during volatility—hold cash equal to 6–12 months of withdrawals before you need it.”

- “Geopolitical shocks don’t announce themselves. The question isn’t if tensions rise, but whether you’re positioned to withstand the repricing.”

Closing: Plan, Don’t Panic

Geopolitical risk is portfolio risk. The operational steps outlined here—liquidity buffers, diversification, stress tests, and hedging—aren’t about predicting outcomes. They’re about building resilience so your wealth survives the repricing cycles that markets inevitably deliver.

If you serve on an investment committee, manage a trust, or advise clients, initiate these conversations now. Review major international news outlets, central bank publications, and commodity market reports regularly. Build governance around geopolitical monitoring.

Legal Disclaimer: This is general information and not investment advice;

Want to actually take action instead of just reading?

Most people understand what they should do with money — the problem is execution. That’s why I created The $1,000 Money Recovery Checklist.

It’s a simple, step-by-step checklist that shows you:

and how to start building your first $1,000 emergency fund without overwhelm.

- where your money is leaking,

- what to cut or renegotiate first,

- how to protect your savings,

- and how to start building your first $1,000 emergency fund without overwhelm.

No theory. No motivation talk. Just clear actions you can apply today.

If you want a practical next step after this article, click the button below and get instant access.

>Get The $1,000 Money Recovery Checklist<

Leave a comment